Are you facing the possibility of foreclosure in Florida?

Foreclosure can feel overwhelming. Owners need to deal with the foreclosure process, legal timelines, court hearings, and eviction if foreclosure isn’t stopped.

People struggling with foreclosure have similar questions:

- How does the foreclosure process work in Florida?

- How long does foreclosure take in Florida?

- What does Florida’s foreclosure timeline look like?

- How long do you have to get out of your house after foreclosure?

- Can I stop foreclosure?

- Is Florida a foreclosure redemption state?

Foreclosure problems can be resolved. Learning some details on what is the foreclosure process in Florida is a start.

This blog by the House Heroes Team dives into information about foreclosure in the Sunshine State.

We Buy Houses – Fast and Fair Cash Offers.

Call Us (954) 676-1846 or Fill Out This Form For Your FAIR Offer.

General Legal Considerations

Let’s clarify precisely what foreclosure is before diving into the details on the Florida foreclosure process. According to James Chen at Investopedia:

Foreclosure is the legal process by which a lender takes control of a property, evicts the homeowner and sells the home after a homeowner is unable to make full principal and interest payments on his or her mortgage, as stipulated in the mortgage contract.

Foreclosure In A Nutshell: When you fail to pay your mortgage, the lender initates the legal process to take over the property and ultimately evicts whoever lives there.

Judicial Foreclosure: Courts Decide The Case

Florida is a judicial foreclosure state.

For a lender to begin foreclosure, the case must be filed and heard in a county court.

Judicial foreclosure means foreclosure must go through the court system, be approved by a judge, and the litigation completes when the home is sold at auction to pay off the mortgage balance.

Florida does not have non-judicial foreclosure. Each and every foreclosure – without exception – proceeds through the courts, has a judge sign off on the sale, and is sold at a public auction conducted by the local county.

Lien Theory: You Own The Property!

Ownership of a house with a mortgage in Florida belongs to you!

This is called “Lien Theory”.

Upon giving you a mortgage, the lender files a “lien” on the property – a document recorded at the county describing amounts owed and your promise to pay.

You (the buyer) are named as owner on the title and deed to the property.

This isn’t the case in all states. Most states outside of Florida are “Title Theory” states – the bank owns the house until the mortgage is paid off.

Florida Foreclosure Laws & Statutes

Brushing up on foreclosure laws, statutes, and procedures might not be a bad idea.

Florida has a procedure called “Fast-Track Foreclosure”.

Here’s how Robert Warren explained it:

Fast-Track Foreclosure is designed to fast track home foreclosures and close out homeowner rights quickly. Mortgage companies can file a “show cause order” soon after the foreclosure case is filed. The show cause order shifts the burden of proof to the homeowner to show why the bank should not be allowed to take their home. Foreclosure cases are expected to process through the system with much greater speed.

Here’s some other key points about Florida foreclosure law:

- Is Judicial Foreclosure Available? Yes.

- Is Non-Judicial Foreclosure Available? No.

- What secures the banks lien? Mortgage.

- Average Timeline? 180-Days

- Equitable Right of Redemption? Yes.

- Statutory Right of Redemption? Yes.

- Deficiency Judgments? Yes.

Consulting with a local foreclosure attorney – particularly if you need to delay or fight foreclosure proceedings – is of the utmost important. The right legal strategy can save your property.

Need help selling a property in foreclosure?

Our company’s mission is to help owners sell property in tough circumstances. Foreclosure, late mortgage payments, and fast closing is our specialty. The House Heroes Team has worked to stop the sale while you work to sell.

Click here learn more about House Heroes and meet our team 🤝!

The Florida Foreclosure Timeline

Losing your house is frightening – and it’s even worse if you’re not familiar with how long it takes to foreclose on a home in Florida.

Understanding how long the foreclosure process is in Florida can help put together an actionable plan to stop the bank from taking your property.

The Florida foreclosure timeline has three “major phases”:

- Pre-Foreclosure: The time from missing a payment until the lender files a foreclosure lawsuit.

- Foreclosure Case: The time the foreclosure lawsuit is open before a judge before the foreclosure sale.

- After Foreclosure: After the foreclosure sale, rights of redemption, eviction, and deficiency judgement timelines begin.

Let’s get into the details of Florida’s foreclosure time.

Pre-Foreclosure

Pre-foreclosure begins when you miss your first mortgage payment.

How long does pre-foreclosure last in Florida?

Pre-foreclosure in Florida lasts a minimum of 120-days per the Dodd-Frank Act. You can extend pre-foreclosure by working with the lender on alternatives to foreclosure and loss mitigation.

Pre-foreclosure is a good time to explore alternatives to prevent the property for getting caught in a foreclosure lawsuit. One option is selling to a real estate investment company like House Heroes Team.

Want to learn more about working with a real estate investor?

What Happens After The First Missed Payment?

Most lenders in Florida allow a 15-day grace period after missing a mortgage payment.

Your mortgage is due on the first of the month, and is considered “late” after 15-days.

At the end of the grace period, you are normally charged a late fee about 5% of the amount of the missed payment. As an example, you will have to pay $50 late fee on a $1,000 mortgage payment if you go over 15-days’ late.

Resolving the late fee as soon as possible prevents recurring late fees every month you remain late.

What Happens At 30-Days Past Due?

The bank may report your delinquent mortgage payment to credit bureaus after it is 30-days’ overdue.

At the 30-day delinquency mark, you will start receiving communications from your lender. The lender will inquire as to why you haven’t made your payments. Use this opportunity to be open and honest with your lender about anticipated payment problems.

Federal law requires the bank to contact you no later than 36 days after the delinquency. According to NOLO:

If a borrower falls behind in payments, a servicer must attempt to contact the borrower to discuss the situation no later than 36 days after the delinquency. If appropriate, the servicer must tell the borrower about loss mitigation options—like a modification, short sale, or deed in lieu of foreclosure—that might be available to the borrower.

By the time your mortgage payment is 45-days late, lenders must appoint personnel to help you with “loss mitigation”.

“Loss mitigation” is a process for a delinquent borrower and lender to work together to avoid the foreclosure process. The majority of loan servicer companies employ workout specialists who will tell you what documents to provide, receive your application, and provide information and answer questions. The lender has 30-days evaluate you for available loss mitigation options and advise you on eligibility.

The servicer must assign a person for the borrower to speak with via phone, available to respond to inquiries, and work with the borrower through the loss mitigation process. The appointed person must assist with:

- available loss mitigation programs available to you;

- steps complete loss mitigation application;

- updates on the review of your application;

- the procedure to appeal a denial of your application;

- when the delinquency will result in filing the foreclosure lawsuit.

What Happens At 90-Days Past Due?

Prior to 120-days past due, the bank could not file foreclosure against you.

Pursuant to the Dodd-Frank Act and Consumer Financial Protection Bureau, there is a “120-Day Loss Mitigation Period” that prevents lenders from filing a foreclosure lawsuit.

The relevant statute is 12 CFR Part 1024 (Regulation X):

Pre-foreclosure review period. A servicer shall not make the first notice or filing required by applicable law for any judicial or non-judicial foreclosure process unless: (i) A borrower’s mortgage loan obligation is more than 120 days delinquent; (ii) The foreclosure is based on a borrower’s violation of a due-on-sale clause; or (iii) The servicer is joining the foreclosure action of a superior or subordinate lienholder.

You can extend the 120-day period by filing the “loss mitigation application” discussed above.

The Foreclosure Lawsuit

Filing the Summons, Complaint, and Lis Pendens

Foreclosure lawsuits in Florida begin by the lender filing a Summons, Complaint, and Lis Pendens.

The “Summons” is legal notice of the foreclosure lawsuit. It demands that you appear before the foreclosure court at a certain date and time. The summons also specifies the time period to file your “Answer”.

Summons are issued to each defendant named in the Complaint. In foreclosure cases, summons are typically served to each borrower on the mortgage. Owners, other lien holders, and occupants of the property.

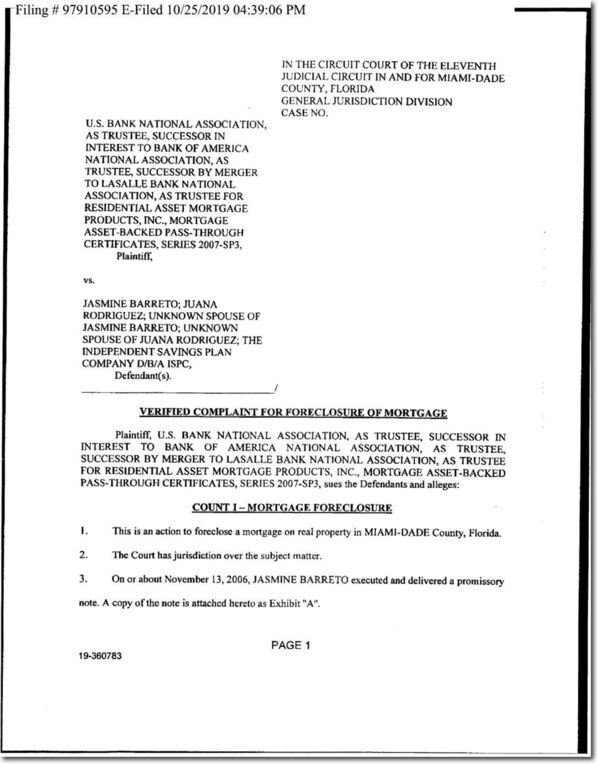

The Complaint.

The “Complaint” sets forth the legal and factual basis for the foreclosure lawsuit.

Foreclosure complaints describe the mortgage and promissory note, the property being foreclosed on, the circumstances of default, and amounts due. Complaints attach “exhibits” (a written copy of the mortgage) and specify the relief sought by the bank (foreclosure sale with the proceeds paying off the mortgage balance).

A foreclosure complaint may look like:

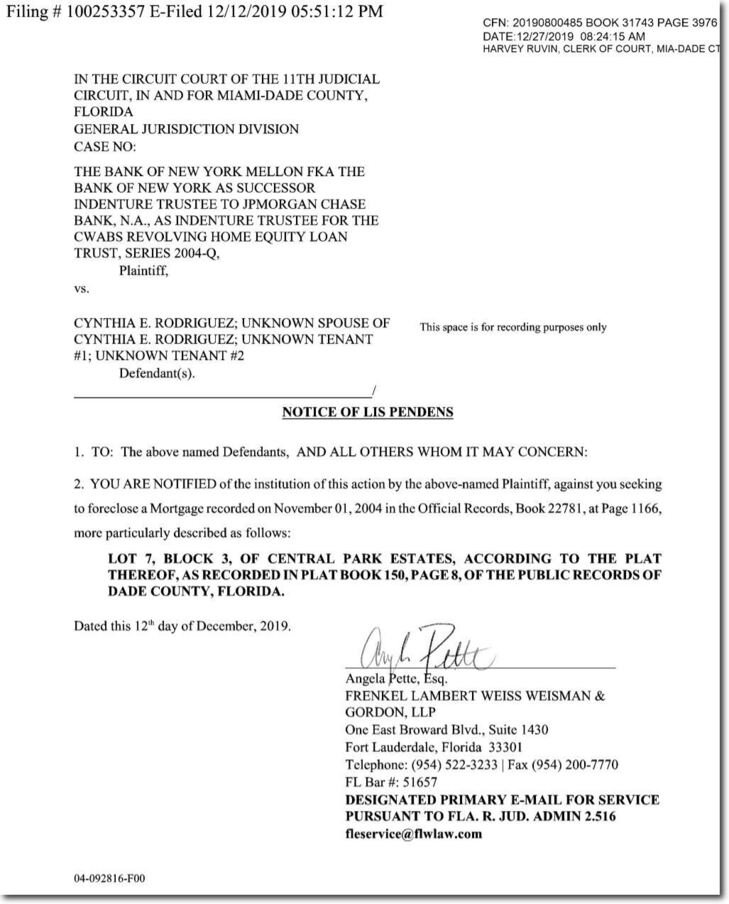

Lis Pendens.

“Lis Pendens” is written notice that the foreclosure lawsuit has been filed against your property. The purpose of lis pendens is to inform the public that there is a lawsuit concerning the property.

Banks foreclosing on Florida property must record the Lis Pendens with the local county. According to Florida Stat. 48.23:

An action in any of the state or federal courts in this state operates as a lis pendens on any real or personal property involved therein or to be affected thereby only if a notice of lis pendens is recorded in the official records of the county where the property is located.

Lis Pendens is several pages long and in Florida must include: names of the parties, filing date of the foreclosure lawsuit, the court hearing the foreclosure, description of the property, and the relief sought.

Here is a sample Florida Lis Pendens document:

Service of Summons & Complaint (10 to 20 days)

The lender is required to “serve” you with the Complaint, Summons, and Lis Pendens concerning the foreclosure lawsuit.

Pursuant to Florida Rule 1.070, service must be issued “upon the commencement of the action authorized by law shall be issued forthwith by the clerk or judge judge’s signature and the seal of the court and delivered for service without praecipe.” Service of process must be made by an officer authorized by law, or the court may appoint any competent person not interested in the action.

The Answer (20 days)

After the lender serves you with the summons and complaint, Florida procedure allows you 20-days to file a response with the court called the “Answer.”

The answer includes responses to claims made by the lender in the Complaint. You typically admit, deny, or state there is insufficient knowledge to each alleged fact.

You can assert legal “defenses” in the Answer. For example, you might assert defenses such you aren’t actually delinquent, violation of laws like the Truth in Lending Act or Fair Debt Collections Practice Act violations, unclean hands, or lack of standing.

Once you file an Answer, a date for a “Preliminary Hearing” is set forth.

The Preliminary Hearing

Following submitting your Answer, attending a preliminary hearing is the next time in the Florida foreclosure process.

During the preliminary hearing, you make your case to the courts and the judge issues a decision was to the next. On some occasions, the court requests that the lender grant you a period of time to resolve the mortgage issues. In other cases, if the court does not view the Answer as sufficient, the courts will allow the matter foreclosure matter to go forward.

If you failed to submit an answer within the required 20-days, the court may “Fast Track” the case to the Summary Judgment in under a month.

The Summary Judgment Hearing (45 days)

At the summary judgment hearing, the lender will present a case to the court to issue a legal ruling in its favor. The lender’s attorney will make this motion only based on non-disputed facts – so this is a time for you to challenge the lender’s factual assertions.

You have an opportunity to show proof of payment or some other grounds that the foreclosure should go forward. At the conclusion of a summary judgment hearing, the court has the option to let the foreclosure go forward.

Lender may input the total amount of financial damages, including the balance on the mortgage, interest, penalties, and other expenses, as part of a summary judgment motion.

Foreclosure Sale Date (75 days)

The court sets may set the foreclosure action after entry of Summary Judgment. At that time, the local county auctions the house at public auction.

Ways To Avoid Foreclosure

If your facing foreclosure, there may be options available to avoid it. Homeowners are sometimes able to prevent foreclosure (and save their house and credit score) with a proactive mindset.

Options to avoid foreclosure include:

- “Mortgage Workout” (working with your lender modify the loan to payments you can afford)

- Selling Before Foreclosure (pay off the mortgage – and get cash in your pocket – with sale proceeds)

- Deed-in-Lieu of Foreclosure (transfer ownership to the bank)

- Filing For Bankruptcy (bankruptcy courts issue an “automatic stay” on creditors)

- Disputing The Foreclosure (assert available legal defenses)

- Renting the Property (use rental profits to make your monthly payments)

- Florida Mortgage Assistance Programs (financial and counseling help)

Check out our How To Stop Foreclosure in Florida [Definitive Guide] to learn about all your options to stop 🛑 foreclosure today!

After Foreclosure

Florida Rights of Redemption

Florida is a foreclosure redemption state.

Owners may be able to “redeem” their home during foreclosure through the Equitable Right of Redemption, and after the foreclosure sale via the Statutory Right of Redemption.

Equitable Right of Redemption: Save Your Property During Foreclosure

Florida’s Equitable Right of Redemption applies to redeem a property during the foreclosure lawsuit.

According to George Castrataro Law, the Equitable Right of Redemption:

Provides you a final opportunity to clear the debt from your mortgaged property before it is seized by the bank and you are legally evicted. Using the right of redemption you must pay the remainder of the mortgage to the lender and any fees they may have incurred from filing for foreclosure.

In other words, you need to pay the balance due on the mortgage plus fees that have been incurred to exercise the Equitable Right of Redemption.

Statutory Right of Redemption: Save Your Property After Foreclosure

Homeowners possibly can save their homes – even after a foreclosure sale – through Florida’s Statutory Right of Redemption.

Florida Stat. 45.0135: states:

At any time before the later of the filing of a certificate of sale by the clerk of the court or the time specified in the judgment of foreclosure, the mortgagor may cure the mortgagor’s indebtedness and prevent a foreclosure sale by paying the amount of moneys specified in the judgment, or if no judgment has been rendered, by tendering the performance due under the security agreement, including any amounts due because of the exercise of a right to accelerate, plus the reasonable expenses of proceeding to foreclosure incurred to the time of tender, including reasonable attorney’s fees of the creditor.

To exercise the Statutory Right of Redemption, owners must refund the purchaser at the foreclose sale the amount they paid for the property, plus interest, fees, and costs.

The time period to file for the Statutory Right of Redemption after the foreclosure auction is brief. The time period lasts until the later of the time “the court clerk files the certificate of sale” or “the time specified in the judgment of foreclosure.

Deficiency Judgment

Even after losing your house, you could still be on the hook for the amount owed not covered by the foreclosure auction proceeds.

The bank seeks to recover the remaining balance by requesting a “deficiency judgment” against you.

Florida is a deficiency judgement state. A deficiency judgment is a mortgage lender’s judgment against the borrower for the difference between the outstanding balance of the mortgage and sale amount the lender received at the foreclosure.

Here is the steps in the process for a deficiency judgement:

- Mortgage lenders in Florida have 1-year to file a motion before the courts to issue a deficiency judgement against you to recover the difference between the auction sale price and amount owed.

- During the court case, the bank must prove the property’s value on the sale date was less than the mortgage balance.

- If the court determines the value of the property was higher than the loan balance at the time of the foreclosure auction, no deficiency judgment is issued.

- If the court determines the value of the property was lower than the loan balance at the time of the foreclosure action, the bank may issue the deficiency judgment against you.

All Law said:

You might think, But the bank foreclosed! I don’t own the house anymore. How can I still owe them money? When you took out the mortgage, you signed two documents. One document was a promissory note, in which you promised to repay the mortgage. The other document was a security agreement in which you pledged your house as security for the loan. The security agreement gave your lender the right to foreclose. But the promissory note lives on, as does your obligation to repay remaining debt.

Eviction After Foreclosure

Wondering how long you have to get out after foreclosure in Florida?

After a foreclosure action, the bank or new property owner has the legal right to evict the previous owner from the property.

Florida foreclosures may include a “right to possession clause”, meaning that after a judgement favorable to the lender is issued, the lender may file a motion for writ of possession. A “writ of possession” is a court order that grants full possession of the property to the lender.

Once the write of possession is released, the sheriff can post it on the foreclosed property, giving the former a short period to vacate. The sheriff’ office has legal jurisdiction to remove the owner if required.

We Buy Houses – Fast and Fair Cash Offers.

Call Us (954) 676-1846 or Fill Out This Form For Your FAIR Offer.

Get A Fair Cash Offer. Call Us (954) 676-1846 or visit our Get A Fair Cash Offer page to find out how much we can pay you!

Our Team. Learn about our values and history. Meet the House Heroes Team – Lucas, Nick, Earl, Danielle, and Meghan!

How It Works. We buy houses in three-steps. Fast, cash, as-is, no realtor fees, fair prices. Learn how we do it!

Testimonials and Reviews. Honesty, integrity, and trust. Check out our video testimonials and social media reviews.

Case Studies. We buy houses in any condition. Watch the inside videos of our purchases – not for the faint of heart!

Frequently Asked Questions. Got some questions about House Heroes? Get all the answers over on our FAQ page.