Are you wondering how many mortgage payments you can miss before foreclosure in Florida?

The number of missed payments before foreclosure in Florida varies depending on the policies of the lender and your personal financial situation.

The number of missed payments before foreclosure in Florida varies depending on the policies of the lender and your personal financial situation.

Some banks are lenient and work with you to avoid foreclosure even after a series of delinquent payments. They may waive missed payment altogether, or spread out amounts due over several months.

Other banks are less forgiving and push foreclosure as soon as possible (even with just a single late payment). Luckily, legal safeguards prevent banks from immediately foreclosing on your home.

Let’s tackle the question of missed payments by walking through what happens from when you miss a payment, until the lender files a foreclosure lawsuit.

What Happens After The First Missed Payment?

Most lenders in Florida allow a 15-day grace period after missing a mortgage payment.

Your mortgage is due on the first of the month, and is considered “late” after 15-days.

At the end of the grace period, you are normally charged a late fee about 5% of the amount of the missed payment. As an example, you will have to pay $50 late fee on a $1,000 mortgage payment if you go over 15-days’ late.

Resolve the late fee as soon as possible – you will incur it every month you remain late.

What Happens At 30-Days Past Due?

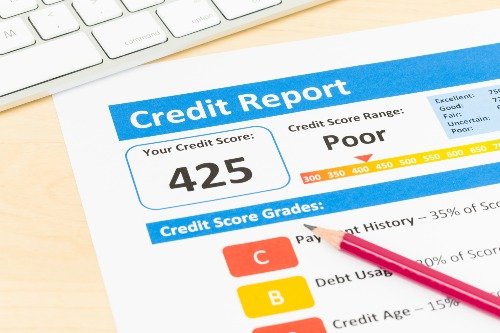

The bank may report your delinquent mortgage payment to credit bureaus after it is 30-days’ overdue.

At the 30-day delinquency mark, you will start receiving communications from your lender. The lender will inquire as to why you haven’t made your payments. Use this opportunity to be open and honest with your lender about anticipated payment problems.

Federal law requires the bank to contact you no later than 36 days after the delinquency. According to NOLO:

If a borrower falls behind in payments, a servicer must attempt to contact the borrower to discuss the situation no later than 36 days after the delinquency. If appropriate, the servicer must tell the borrower about loss mitigation options—like a modification, short sale, or deed in lieu of foreclosure—that might be available to the borrower.

By the time your mortgage payment is 45-days late, lenders must appoint personnel to help you with “loss mitigation”.

“Loss mitigation” is a process for a delinquent borrower and lender to work together to avoid the foreclosure process. The majority of loan servicer companies employ workout specialists who will tell you what documents to provide, receive your application, and provide information and answer questions. The lender has 30-days evaluate you for available loss mitigation options and advise you on eligibility.

The servicer must assign a person for the borrower to speak with via phone, available to respond to inquiries, and work with the borrower through the loss mitigation process. The appointed person must assist with:

- available loss mitigation programs available to you;

- steps complete loss mitigation application;

- updates on the review of your application;

- the procedure to appeal a denial of your application;

- when the delinquency will result in filing the foreclosure lawsuit.

What Happens At 90-Days Past Due?

At 90-days past due, you normally receive a “breach letter” from the bank on most Florida mortgages.

A “breach letter” is a notice from the lender informing you the mortgage is in default. It is sent before calling the entire loan due and filing a foreclosure lawsuit. Breach letters also identify the steps to cure the default, a due date to resolve the delinquency, and state that failure to cure the default by the due date may result in a foreclosure lawsuit.

This is your “last chance” to prevent a foreclosure case opening up with the courts. Contact the bank to discuss a “mortgage workout” such as repayment plan, special forebearance, or refinancing. Consider options such as selling the property outright, or renting it to catch up on lost payments. Bankruptcy is another solution people consider to delay onset of foreclosure proceedings.

Our company House Heroes buys houses in Florida – including cash closings for properties facing foreclosure. Click here to learn how our “Three Step Home Buying Process” works ⚙️.

What Happens At 120-Days Past Due?

Prior to 120-days past due, the bank could not file foreclosure against you.

Pursuant to the Dodd-Frank Act and Consumer Financial Protection Bureau, there is a “120-Day Loss Mitigation Period” that prevents lenders from filing a foreclosure lawsuit.

The relevant statute is 12 CFR Part 1024 (Regulation X):

Pre-foreclosure review period. A servicer shall not make the first notice or filing required by applicable law for any judicial or non-judicial foreclosure process unless: (i) A borrower’s mortgage loan obligation is more than 120 days delinquent; (ii) The foreclosure is based on a borrower’s violation of a due-on-sale clause; or (iii) The servicer is joining the foreclosure action of a superior or subordinate lienholder.

You can extend the 120-day period by filing the “loss mitigation application” discussed above.

The Foreclosure Filing

If you have not resolved missed payments or obtained time extensions, your lender may proceed to file a foreclosure lawsuit after the late payment is 120-days overdue.

The lender begins by filing a “Notice of Default” (known as a “Lis Pendens”) and Complaint in the Florida county where the property sits. The bank is required to serve you with the Complaint, and you then have 20-days to respond to the Complaint with your “Answer”.

If you fail to respond to the Complaint, the court may enter a default judgment in favor of the lender.

If you haven’t already, contact a local foreclosure attorney or approved foreclosure counselor to go over legal defenses and all other available options.

Ways To Avoid Foreclosure

If your facing foreclosure, consider every option. Homeowners are able to prevent foreclosure (and save their house and credit score) with a proactive mindset.

Options to avoid foreclosure include:

- “Mortgage Workout” (working with your lender modify the loan to payments you can afford)

- Selling Before Foreclosure (pay off the mortgage – and get cash in your pocket – with sale proceeds)

- Deed-in-Lieu of Foreclosure (transfer ownership to the bank)

- Filing For Bankruptcy (bankruptcy courts issue an “automatic stay” on creditors)

- Disputing The Foreclosure (assert available legal defenses)

- Renting the Property (use rental profits to make your monthly payments)

- Florida Mortgage Assistance Programs (financial and counseling help)

Check out our How To Stop Foreclosure in Florida [Definitive Guide] to learn about all your options to stop 🛑 foreclosure today!

We Buy Houses – Fast and Fair Cash Offers.

Call Us (954) 676-1846 or Fill Out This Form For Your FAIR Offer.

Get A Fair Cash Offer. Call Us (954) 676-1846 or visit our Get A Fair Cash Offer page to find out how much we can pay you!

Our Team. Learn about our values and history. Meet the House Heroes Team – Lucas, Nick, Earl, Danielle, and Meghan!

How It Works. We buy houses in three-steps. Fast, cash, as-is, no realtor fees, fair prices. Learn how we do it!

Testimonials and Reviews. Honesty, integrity, and trust. Check out our video testimonials and social media reviews.

Case Studies. We buy houses in any condition. Watch the inside videos of our purchases – not for the faint of heart!

Frequently Asked Questions. Got some questions about House Heroes? Get all the answers over on our FAQ page.