Are you looking to sell a house as-is in Florida?

Perhaps you prefer a simple and fast sale, or the house could use some work and you’d rather save time and money.

You might be wondering what “as-is” really means, and whether you even can sell a house as-is in Florida. Learning what must be disclosed to the buyer will save you headaches in the long run.

Read on to learn about “as-is” sales in this blog from the House Heroes Team!

We Buy Houses (In Any Condition)

Call Us (954) 676-1846 or Fill Out This Form For Your FAIR Offer.

Can you sell a house “as is” in Florida?

You can sell a house as-is in Florida.

Although legal disclosure requirements exist, property is sold everyday “as-is”. Making repairs before closing is completely optional.

The real question is whether you should sell as-is, or pay for repairs during the sale process.

Let’s weigh the pros and cons of selling as-is . . .

The Pros of An As-Is Sale

Fast Sales

Closing fast is the biggest advantage of an “as-is” sale.

How long does it takes to renovate a house and then sell on the open market? Take a glance at these statistics:

- Average Time to Sell After Listing: 68 Days [Zillow]

- Average Time To Close After Contract: 40 Days [The Balance]

- Average Time For Mortgage Approval: 45 Days [Mortgage Reports]

- Cosmetic Renovations Only: 2-3 Months [Flip Academy]

- Full Property Renovation: 3-12 Months [Flip Academy]

The average time from beginning renovations to selling is 6-months for cosmetic rehab, and 12-months for substantive repairs. Selling a house “as-is” by owner takes just a few weeks.

Save Money on Repairs

Home renovations empty a bank account. Quick. Updating an older house costs tens of thousands of dollars.

Home Advisor created a detailed guide outlining current renovation costs. Check out the details below:

- Kitchen Remodel: $4,500 – $49,000

- Bath Remodel: $6,000 – $14,000

- Bedroom Remodel: $1,000 – $5,000

- Appliances: $1,000 – $10,000

- AC Unit: $4,000 – $6,000

- Furnace: $3,000 – $5,000

- HVAC: $1,900 – $4,900

- Roof: $5,000 – $7,000

- Plumbing: $45 – $512

- Basement: $10,579 – $27,000

- Ducts and Vents: $500 – $2,000

- Landscaping: $500 – $5,000

- Knocking Down Walls: $300 – $500

- Square Footage: $7,000 – $100,000

- Permitting: $100 – $3,000

According to Houzz author Erin Carlyle:

So how much does a renovation cost? The total cost depends on the project’s scope, the materials selected and the fees of the professionals hired to do the job. Owners who completed our survey spent an average of $59,800 on renovations.

Avoid Stress

Renovating a house is a headache 😫.

Dealing with contractors, unanticipated repairs and costs, months of delays. Rehabs test the patience of even seasoned real estate professionals. The frustrations even damage personal relationships.

Common reasons home renovations become stressful include:

- Not Knowing Where To Begin. First time renovator? It’s more complicated than Flip or Flop.

- Disappearing Money. Nobody likes watching their bank account drop tens of thousands of dollars.

- Surprise Defects. “The best laid plans of mice and men often go awry.” Robert Burns.

- Interrupting Home Life. Breakfast with your kids? Usual sleeping spot? Quality time with a spouse?

- Contractors. Renovations require interviewing and hiring contractors, who sometimes disappear or do sub-standard work

- Lost Time. Planning, letting contractors in daily, overseeing the process. It’s bumpy ride if your schedule is already jam-packed.

The Cons of An As-Is Sale

Lower Sale Proceeds

An ugly house isn’t worth nearly as much as a beautiful one.

Renovating an old house builds market value in two ways. Financial Investment. Renovating is big cash out lay. Buyers pay more for benefits of renovations without spending the money themselves. Sweat Equity. Even basic cosmetic repairs can take months of contractor supervision. This work builds “sweat equity”: you spent time and energy on renovations and now the buyer doesn’t have to.

Buyers offer substantially less for houses that require them spend financial resources and days of their lives to renovate.

Less Buyers Are Interested

Everyone hopes to one day buy their dream home.

The mental images never appear like these “ugly houses” 🏚 we bought:

The majority of home buyers aren’t interested if you’re selling a house in poor condition. You will lose these buyers when selling a home in need of renovations:

- Buyers With Mortgage Financing: Most home buyers rely on conventional mortgages. Houses with notable defects aren’t approved for a mortgage: broken window panes, leaking plumbing, electrical problems, an old or leaky roof, termite damage, lead paint. The sale must be “cash only” if any of those problems exist.

- Buyers That Need To Move In: Looking to sell a house a bad shape such that buyers wouldn’t be able to comfortably move-in upon closing? Homeowners that need to move in pronto may pass on major fixer-uppers.

- Buyers That Desire a Turnkey Property. Many buyers aren’t interested in making repairs. They may live remotely, be too busy to handle repairs, or simply have enough money they don’t need a “cheap” house.

Pros & Cons of Selling a House AS-IS Comparison

Reasons To Sell “As-Is”

- Save Thousands of Dollars

- Don’t Waste Months of Your Life

- No Renovation Headaches

- Sell In a Few Weeks

- Avoid On-Going Monthly Payments

Reasons To DIY Renovations

- Increase Sale Value With Sweat Equity

- Increase Sale Value With An Updated House

- Bigger Pool of Interested Buyers

- Potential For Multiple-Offer Competition

- Free Time, Money, Rehab Experience

What does “as is” mean?

As-is in Florida means selling the house in its present condition or as it exists immediately prior to closing, even if there is property damage or defects, without the seller making or paying for modifications or repairs.

Owners sometimes ask us how “as-is” differs from selling Site Unseen, No Inspection Contingency, and Price Negotiations.

Allowable Inspections. The vast majority of “as-is” sales allow the buyer to inspect the property. Offers usually contain an inspection period of about two weeks to check the house’s condition.

Selling Site Unseen. Selling “site unseen” means the buyer is not able to enter the premises. No walkthroughs, no property inspectors, no repair quotes. Site unseen sales involve squatters or dangerous conditions.

Re-Negotiating Price. “As-is” doesn’t mean the buyer can’t re-negotiate price. If the offer had a standard inspection period, the buyer has 3 options at the end of inspection: close at the agreed upon price, cancel, or re-negotiate price.

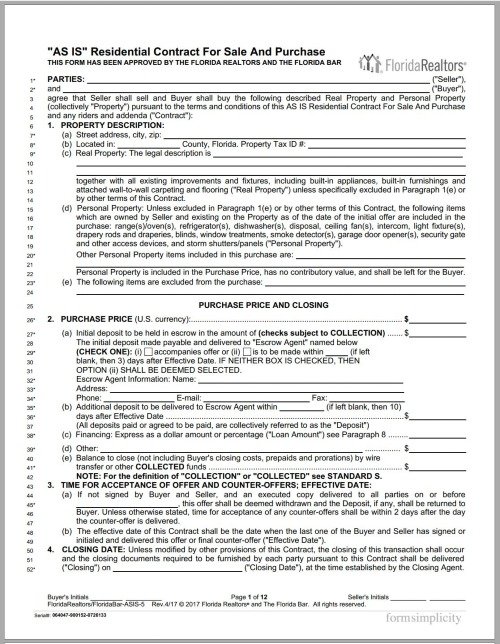

What is an as-is contract in Florida?

The State Bar and Board of Realtors approved an as-is contract in Florida. The as-is contract addresses price, closing date, escrow, financing, closing costs, disclosures, occupancy, and inspections.

Although it’s tempting to focus on offer price, it’s wise to review the “fine print” in written offers. An offer is only as good as the contract terms. Pay attention to these contract provisions:

Escrow Deposit. An escrow deposit is amount put into an “escrow account” after a seller accepts an offer. It is held by an attorney or broker. The deposit often serves as the remedy if the buyer breaches the contract.

Inspection Period. The “inspection period” is the time buyers perform due diligence on property they buying. Florida inspection periods by default last 15-days but the time is negotiable.

Appraisal Contingency. An appraisal contingency allows a buyer to cancel if the home appraised too low. Appraisals in Florida are typically conducted by Certified Residential Appraisers.

Financing Contingency. A financing contingency means that a buyer may cancel if they are unable to obtain the cash for the sale. This comes into play when a buyer is relying on a mortgage, and the banks refuses based on poor condition, credit, or income. House Heroes LLC is a cash buyer in Florida – no mortgages necessary! Visit our “How It Works” ⚙️ page to learn about our “3 Step Home Buying Process”.

Closing Date. Closing date is the final stage of a sale. Closing is set during negotiations and scheduled about a month after an offer is accepted. Funds are transferred to the buyer via wire or check, seller signs the deed and records it, and the seller hands over the keys.

Closing Costs. Before the buyer gets keys and the seller gets cash, closing costs must be paid. Sellers can be surprised when net sale proceeds shrink. The seller traditionally pays certain closing costs, and the buyer others. Closing costs are negotiable and in Florida average 1 to 2% of sale price. House Heroes buys “as is” and pays closing costs. Call us (954) 676-1846 or visit our Get A Cash Offer Today! 💰 page to find out how much cash we can offer you.

What to disclose when selling a house “as is” in Florida?

Selling “as-is” doesn’t remove your obligation to disclose property defects in Florida.

You don’t want to get a telephone call from the buyer two years down the road accusing you of selling them “a lemon”. Pay attention to disclosure requirements to save time and money in the long run.

Both the standard “residential as-is” contract and Florida case law discuss home seller disclosures.

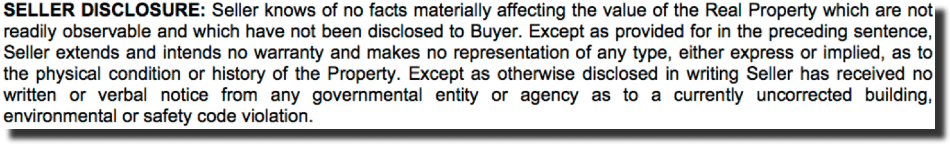

“Seller Disclosure” In Approved “AS-IS” Contract

The bar approved “as-is” residential contract includes a default “Seller Disclosure” provision: “Seller knows of no facts materially affecting the value of the Real Property which are not readily observable and which have not been disclosed to the Buyer.”

In other words, this “Seller Disclosure” provision requires you to disclose “material” defects you are aware of that are “not readily observable”.

See the full provision below:

Florida Law: Johnson v. Davis, 480 So.2d 625 (Fla. 1986)

Florida law also requires disclosure of hidden material defects that you are aware of and the

Following the Florida Supreme Court’s decision in the case of Johnson v. Davis (480 S0.2d 625 (Fla. 1986), home sellers are required to disclose latent defects they are aware of that materially affect the value of property that are not readily observable or known to the buyer.

According to the court “where the seller of a home knows of facts materially affecting the value of the property which are not readily observable and are not known to the buyer, the seller is under a duty to disclose them to the buyer. This duty is equally applicable to all forms of real property, new and used.”

In other words, “[a] nondisclosure claim under Johnson has four elements:

(1) the seller of a home must have knowledge of a defect in the property,

(2) the defect must materially affect the value of the property,

(3) the defect must be not readily observable and must be unknown to the buyer, and

(4) the buyer must establish that the seller failed to disclose the defect to the buyer.”

See Jensen v. Bailey, 76 So. 3d 980 (Fla 2d DCA 2011).

Seller Disclosure of Termite Damage in Florida

Florida’s warmer temperature creates a prime breeding ground for termites. Sun Sentinel reported parts of Florida have seen a 30% increase in termites over the last five years.

Do you need disclose termite damage when selling your house in Florida?

Sellers in Florida must disclose termite damage that materially affects property value, if they are aware of it, and the damage is not readily observable and unknown to the buyer.

House Heroes Team: Our Recommended Disclosures

Our company has purchased houses in need of major repairs since 2013. Check out this list of material defects that we’ve encountered that you should consider when you’re conversing with a buyer.

- Roof leaks or defects

- Plumbing or drainage problems

- Water damage

- Window cracks or malfunctions

- Code Violations

- Basement flooding

- Heating and cooling defects

- Toxic Materials (asbestos, lead)

- Environmental risks (flood zone)

- Faulty electrical wiring

- Foundation cracks or instability

- Infestation (rodents, termites)

- Noisy or disruptive neighbhors

- Paranormal activity

- Deaths on property

We Buy Houses in Florida

Call Us (954) 676-1846 or Fill Out This Form For Your FAIR Offer.

Get A Fair Cash Offer. Call Us (954) 676-1846 or visit our Get A Fair Cash Offer page to find out how much we can pay you!

Our Team. Learn about our values and history. Meet the House Heroes Team – Lucas, Nick, Earl, Danielle, and Meghan!

How It Works. We buy houses in three-steps. Fast, cash, as-is, no realtor fees, fair prices. Learn how we do it!

Testimonials and Reviews. Honesty, integrity, and trust. Check out our video testimonials and social media reviews.

Case Studies. We buy houses in any condition. Watch the inside videos of our purchases – not for the faint of heart!

Frequently Asked Questions. Got some questions about House Heroes? Get all the answers over on our FAQ page.